Provisional Patent Applications Hurt Startups

Bad Strategies for Startup Patents

The patent bar does a terrible job of serving smaller clients – and provisional patent[1] applications are a glaring example.

In fact, they are taking advantage of them and causing harm to the clients they are supposed to serve.

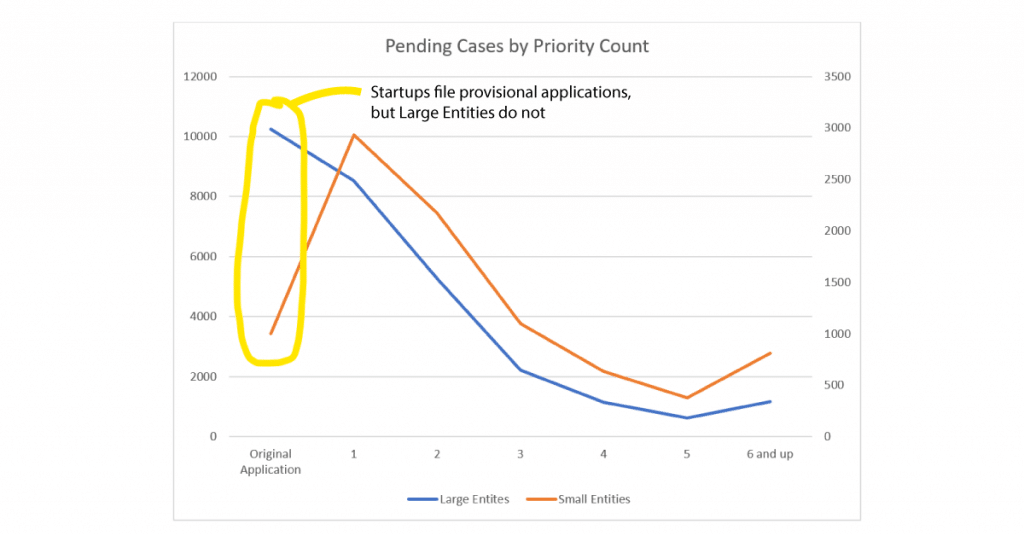

The graph shows a recent snapshot of office actions over the last 120 days and the priority count for those pending applications. Large entities tend to be working on the original application, while small entities (less than 500 employees) tend to be working on the second application. This is because startup companies tend to use the devastating tactic of filing a provisional patent application, then file a non-provisional application a year later.

Provisional patent applications are always – always – wrong for a startup company, and most patent attorneys know this intuitively, but may not be able to articulate why.

The Patent Bar takes advantage of startup companies by luring them into a “low cost” provisional application, which *delays* getting their patent. But once the provisional patent is filed, the client feels obligated to spend more money on the patent.

The cruel misfortune: the client thinks that they are deferring costs by a year, but provisionals actually cost them far more overall.

Provisionals Make International Protection Far More Expensive

Many companies want to delay their expenses, which is very reasonable.

However, they often come to a decision point where they need to decide about filing in foreign countries. This decision is 30 months (two and a half years) after their earliest filing date.

For startup companies who choose to “save” money by filing a provisional application then a non-provisional a year later, they are stuck with an un-examined patent application at the 30 month point.

The companies who try to “save” money wind up filing in foreign countries and paying *three or four times as much* for the back-and-forth with the examiner. This is because there is no allowable patent yet, so they have to pay for the patent prosecution in multiple countries – all at the same time.

There is a great benefit to the patent attorney: they get paid to do the job three times over.

A much better strategy (for a startup) is to get the examination done quickly and before the 30 month deadline. If we have allowable claims by then, we can make a data-driven decision to select the countries for foreign filing. We know the scope of the claims, and we do not pay for multiple patent attorneys in multiple countries to make the same arguments with each of the patent offices in parallel.

Companies who think that foreign filing might be an option for them should always try to get patents quick[2]ly so they have a basis to decide whether foreign filing is worth it.

Signaling to Investors

One of the myths about provisional patent applications is that they are somehow “cheaper.” Provisional patent applications must meet the exact same requirements of a non-provisional patent application.

It should be noted that some patent attorneys will file “cheap” provisionals “at the request of their client.” These might be $1500 patent[3] applications where the non-provisional would cost $12,000. In every instance, this is borderline malpractice and the startup is guaranteed to be losing protection, not gaining it.

When filing the patent application, the attorney checks the box either “provisional” or “non-provisional.” The only real difference is the price: $130 for provisional and $830 for non-provisional.

What does this tell investors?

It says that the entrepreneur did not believe the patent was worth the extra $600.

If you see an entrepreneur tout a provisional patent application, look at their actions, not their words. If they believed the patent would be an asset to the company, they would have invested the extra $600.

Ask the entrepreneur how much they think the patent might be worth and compare it to what their actions say. If the patent is worth doing, it is worth doing right.

Learn from the Pros

Large entities tend to have far more sophisticated patent strategies than their smaller rivals. Large entities understand that getting a patent faster – rather than delaying prosecution with a provisional – creates a more valuable business asset that they can put to use.

Large entities understand that early examination helps them decide whether or not to pursue international filing, so they file non-provisional applications as a cost savings measure.

Large entities understand that they can always use a Continuation-In-Part application to add more material to the invention. The CIP application can be filed in 3 months or 3 years later, and they are not held to an arbitrary one-year deadline to add new material.

Large entities understand that provisional patent applications are a statement: “I don’t believe in this invention.” Here’s more about BlueIron’s investment thesis for patent financing.

Learn more about provisional patent applications here.

About the chart:

The chart reflects the patents that received a non-final Office action in the 120 days prior to 15 Feb 2021. Each patent was grouped by large and small entities, and by the number of priority applications. The “small entities” are USPTO’s “small entity” applicants minus non-profit applicants such as universities. Data provided from AcclaimIP.

References

- The Provisional Patent Hoax ↩

- Getting Patents Fast in Investing in Patents, Ch. 4 (Book) ↩

- Patent Costs in Investing in Patents, Appendix B (Book) ↩