Venture Capital Investments in Patent-Heavy Companies is Down Substantially

The Alliance of US Startups and Inventors for Jobs (USIJ) issued a report in July 2020 showing how Venture Capital has shied away from patent-intensive startups over most of the last two decades. This corresponds with the undermining of the US patent system through several Supreme Court cases during the period.

The patent system is clunky and weird, but it usually works. However, it is broken in ways you do not expect.

The key findings of the report:

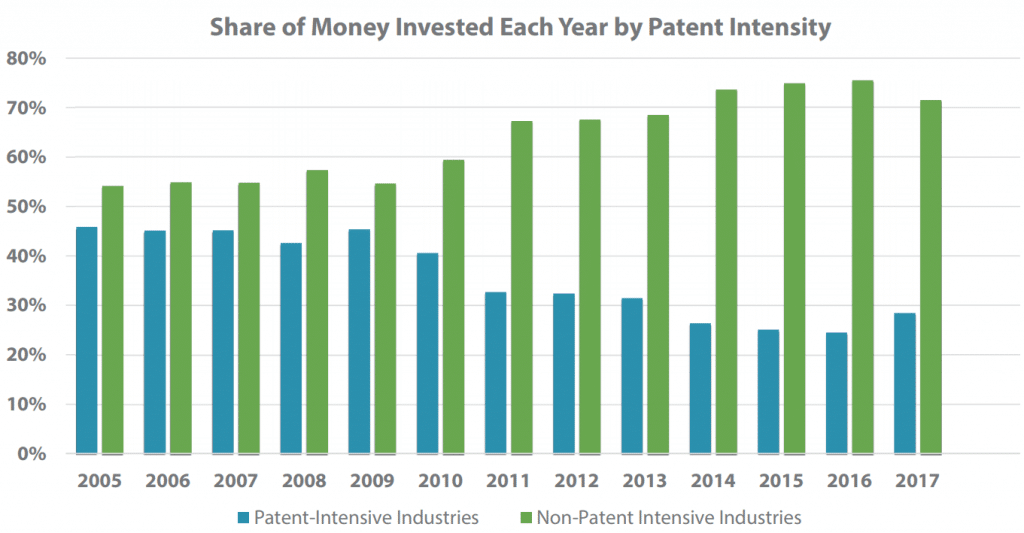

The share of venture capital funding received by the most patent-intensive

businesses dropped from over 50% in 2004 to about 28% in 2017.

The data show a precipitous decline in the relative share of funding going to

companies developing products in the pharmaceutical and biotech sectors.

Overall, the sector has experienced a 20% decline in share of funding.

VC investment in pharmaceuticals went from a 7% share of all investments in 2004 to a 0.79% share in 2017. In 2008, the share of all VC funding going to medical devices was nearly 12% of all VC funding. By 2015, the share halved, dropping to less than 6%, where it remains.

The share of funding for businesses developing patent-intensive high-tech

hardware, such as computer hardware and semiconductors, has dropped

significantly.

In fact, startup companies creating semiconductors now receive less funding in both relative and absolute terms, as they received not just a smaller share of funding but about $1 billion less in funding from 2013–2017 than they did from 2004–2008.