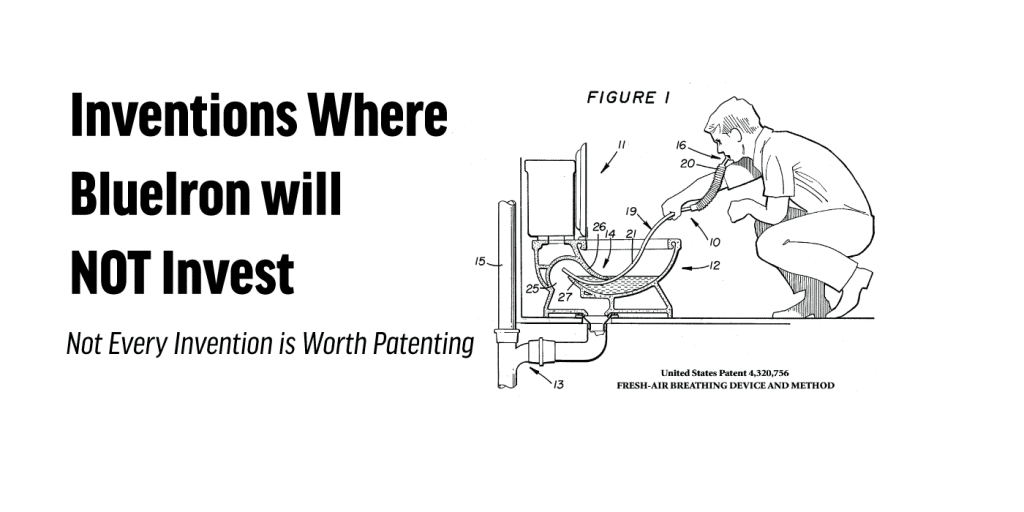

Inventions Where BlueIron Does NOT Invest

There are some inventions where BlueIron will NOT invest.

I see an obnoxious number of inventions and patents from startups. I estimate that I encounter 10-20 inventions per week lately, and many are not good candidates for us to invest. It is heartbreaking to say “no” to inventors where the invention does not seem to be ‘big’ enough to be a saleable, stand-alone asset.

Our investment thesis is to invest where the invention has the possibility of becoming valuable. We are not looking for a huge lottery ticket, but something that will be a solid performer. BlueIron’s business model relies on the startup company being successful, because that is the only way the patent asset will have some value.

We need to see an invention that has the following characteristics:

1. We invest where an invention has a solid economic advantage over other ways of solving the same problem.

For a patent to have value, it must be licensable or saleable in its own right. Many patents might not fit this category because they are for defensive use, or might be used only to protect a company’s niche product.

Many times, a company’s core products are useful and practical, but they might not provide a very large economic impact. For example, an invention that has a new way of packaging a device may be good to protect for that company, but a patent on that technology does not have much commercial value because there are many different ways to package the same device.

This kind of patent is useful to the company because it gives them some substance to license their packaging, but it is not very useful as a stand-alone asset because the design-around[1] costs are minimal.

2. We invest when the invention has a long shelf life.

Many inventions/products have a short window of opportunity. The Pet Rock was a great invention, but never had any staying power.

I classify many inventions (and startup concepts) as “gimmicks”, but I don’t mean that in a derogatory fashion. I use the term to mean that they address aesthetic value, but not substantive impact to the business itself. Well, I must admit that it is somewhat derogatory.

3. We invest when the invention is a breakthrough in a big field.

The valuable patents are those that establish a large beachhead where many technologies and applications flourish. These patents can be very valuable, but they are extremely difficult to write well. If done well, these applications will let your invention reach a very wide technology base – and the patent will be able to survive litigation.

These patents take a lot of extra work to do well. The work comes in fleshing out the entire technology. Lots of inventors come to me with a wish to have a patent in a certain area. “I want a patent that protects X”, but the inventor may not fully know how to implement X. The patent application involves a lot of engineering/invention/research to explain each piece that is necessary to build the invention.

Often, the valuable invention is not the end product but the problem solved on the way to the product.

Sadly, these inventions do not come from the run-of-the-mill startup. It takes a special startup with often a unique pedigree to produce breakthrough concepts. These special startups usually come from someone with deep experience in their industry and has stumbled on a real problem that needs to be solved.

Of course, these patents are the IP unicorns. These inventions are often very, very early, and there may be several startups that attack the space before the technology comes of age. In some cases, these patents may actually expire before the market comes around and the patents would have been valuable.