Management of Patent Risk

Cipher.ai regularly releases some very interesting articles on patent risk. Their November 2021 article on “Management of Patent Risk” is available here.

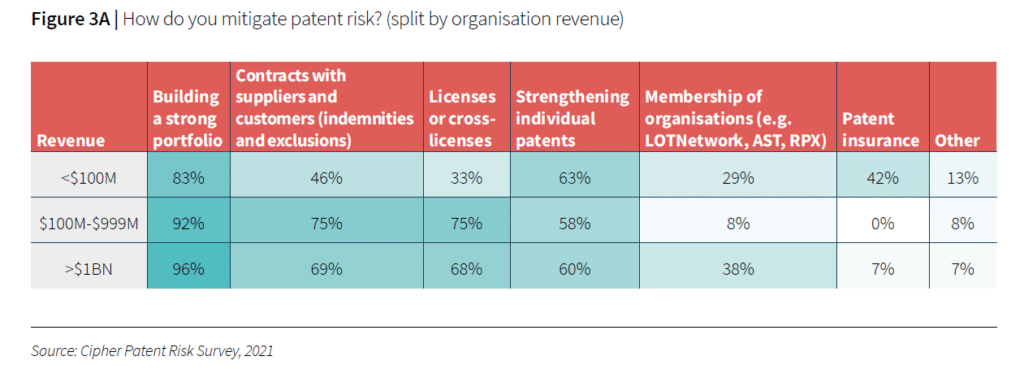

Cipher.ai surveyed 122 companies to look at strategies for handling IP risk.

The IP risks are several. Cipher.ai uses the risk categories outlined in Edison in the Boardroom:

- Intrinsic risk – the risk that not every granted patent is valid and enforceable.

- Environmental risk – uncertainty based on changes in patent law, including the perceived devaluation of IP in the US.

- Innovation risk – inherent uncertainty of infringing a competitor’s patent.

- Assertion risk – risk of being able to successfully license/enforce a company’s patent against a competitor.

- NPE risk – non-practicing entities who are immune to counter-assertion when they enforce their patents.

How companies deal with patent risks.

The table at the top of this post shows the basic strategies companies use for patent risks.

The primary strategy is building a strong portfolio

A strong patent portfolio is an enormous set of trading cards. One of my friends used to be in-house counsel at Hewett Packard. He said the mission of the patent group was to “give engineers freedom to invent.”

A strong patent portfolio gives a company the ability to “trade” for technologies that another company has.

Licensing and cross-licensing

This is done in two different ways. The first is to actually negotiate a cross-license agreement. A formal cross-license agreement is a covenant not to sue, where both companies identify the specific patents or technologies that each company wants to trade.

Companies that have a bigger portfolio often get a royalty payment from a smaller company when there is an imbalance. Early in my career, I was an engineer at Maxtor, a disk drive company. Our competitor, Connor Peripherals, was literally across the street. The two companies met because Conner believed we at Maxtor infringed one of Connor’s three patents.

In the conference room, Maxtor brought their 10 or 15 patents and compared them to Connor’s three patents. Maxtor walked out of the conference room with a royalty agreement where they cross-licensed their patents, but Connor had to pay Maxtor $5M.

While I was at Hewlett Packard in the 1990’s, HP would occasionally get letters from competitors, where the competitor would gently assert that HP was infringing a patent. HP’s legal group would go through HP’s own patents to find several that the competitor infringed. Rather than formalizing a cross-license, they would quietly make the competitor crawl back in their hole.

Contracts with suppliers and customers

Patent risks roll up and down the supplier chain. Some companies may have a much higher risk exposure due to their prominence. There are two schools of thought for asserting patents: starting at the top or starting at the bottom.

Many non-practicing entities start at the bottom of the food chain and work their way up. They will finance their patent litigation by several nuisance lawsuits that settle quickly. This helps build a war chest that funds the “real” litigation against a big company that fights back.

Other companies have a strategy of knocking off Goliath first, then demanding high royalties from all the smaller players. This strategy generally takes much more capital to pull off, but can yield much more returns.

Most customers require indemnification of their suppliers for patent infringement. If you sell a product that infringes and your customer gets sued, you wind up having to defend your customer in court. This can happen to the smallest startup companies, which is why indemnification insurance is essential.

Patent insurance

Interestingly, 42% of the smaller companies mitigate their patent risk through patent insurance.

Patent insurance, just like fire insurance, is an insurance policy that spreads the risk across the policy holders. By paying a modest amount that reflects the cost of the problem multiplied by the likelihood of it occurring, a company can transfer the patent risk to an insurance company.

It should be noted that premiums for patent insurance are much higher when a company does not have a meaningful patent portfolio. This is because the cost of defending lawsuits can be very high compared to settling a dispute through cross licensing as described above.