IP-Backed Lending In Asia

Intellectual property-backed lending, particularly patent-backed lending, has been growing in Asia, particularly China and Korea. Both countries have made extensive efforts to use IP as a business resource for growing their economies. Maybe the US can use part of this playbook?

China’s IP Emphasis is a Huge Asset to SMEs Seeking Financing.

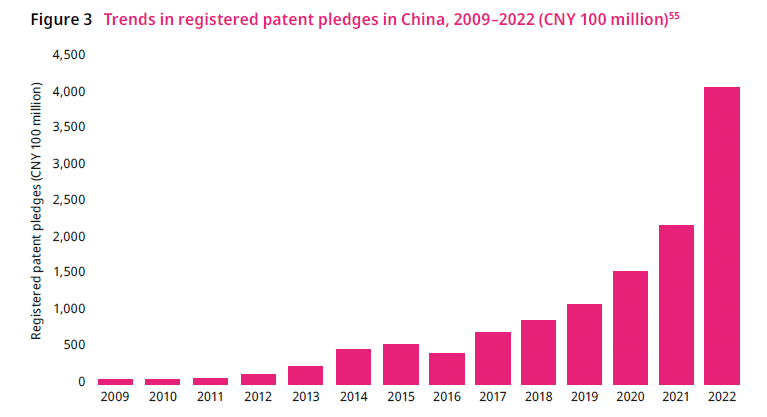

$67B in loans were made using IP as collateral in China in 2022. This rapid growth reflects China’s incentives to grow SME businesses, but it also appears to be part of China’s increasing emphasis on intellectual property.

No longer is China the backwater where DVDs of pirated software are traded by street vendors. Now, China has robust courts that actively enforce patents. In China, 80% of all patent plaintiffs won their patent cases and 90% successfully got injunctions. In fact, China is a very good place to enforce your patents – much better than the US.

IP is only as valuable as its ability to enforce. In the US, patent enforcement cases are long, expensive, and the ability to get injunctions was destroyed years ago with the Ebay decision.

Now that China has made a wholesale change to make IP a valuable, legally powerful business asset, they are beginning to reap the benefits: the ability to make business loans using IP as collateral.

This playbook is being used by other Asian countries, notably Korea.

Korea has Sophisticated IP-Backed Lending.

Overview of Korea’s IP-Backed Lending Programs

Korea has developed a robust framework for IP-backed lending, aimed at supporting small and medium-sized enterprises (SMEs) and fostering innovation.

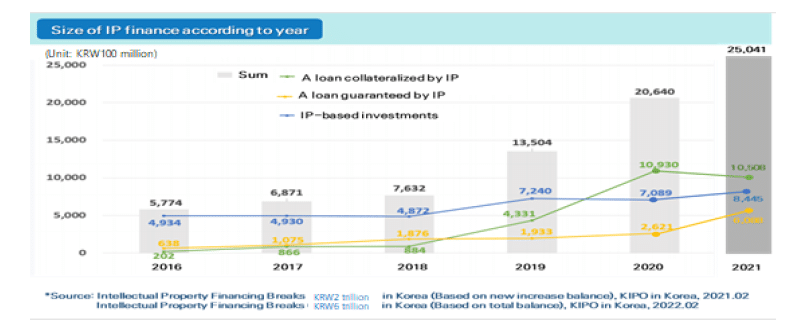

Korea had $1.4B USD loans in place in 2021 using IP finance.

Korea’s approach is to value the IP using Korea Invention Promotion Association’s SMART5 as well as other valuation systems. Once the value of the IP is established, loans up to 70% of the value can be made.

Korea has been at the forefront of intentionally and deliberately investing in their IP infrastructure. As many patent filers know, international patent filers using the PCT system always prefer Korea’s searches over the US. (In 2005, the USPTO outsourced PCT searches to a beltway bandit, and their searches are notoriously unreliable.)

As KIPO has become the go-to place for patent searches, Korea has invested heavily in patent valuation and government-supported IP-backed loan programs for SMEs.

These types of investments have unlocked financial resources for SMEs. Most early stage and startup companies are rich in IP, but short on cash. Using IP as collateral gives them more runway and a greater chance at success.

Every entrepreneur and inventor believes – rightly – that their patents have value. But the challenge is finding mechanisms to turn that perceived value into cash. IP-backed financing is one mechanism that is becoming better developed over the last several years, and China’s and Korea’s examples are ones to study.