Pitching Investors is Not “One-and-Done”

Spend some time “riding the bus” in the Minors before getting to the Big Leagues.

I have the enviable position of seeing lots of inventors who bootstrapped their companies along before they take outside investment (if they take any outside investment at all). This is – without question – the single best way to build a business.

However, going at it alone with a small bank account is difficult. There is a constant tradeoff between wanting to invest in the business in many different ways, but only having money for one. Wouldn’t it be great to have a huge pile of money and not be forced to make those hard decisions?

When these entrepreneurs consider taking outside investment, they immediately target very sophisticated angel groups or venture capital companies. Raising outside investment is not as easy as they think.

Angel/Venture Money is not Cheap.

Angel and venture money is not cheap. In fact, it is very expensive, and far more expensive than entrepreneurs realize.

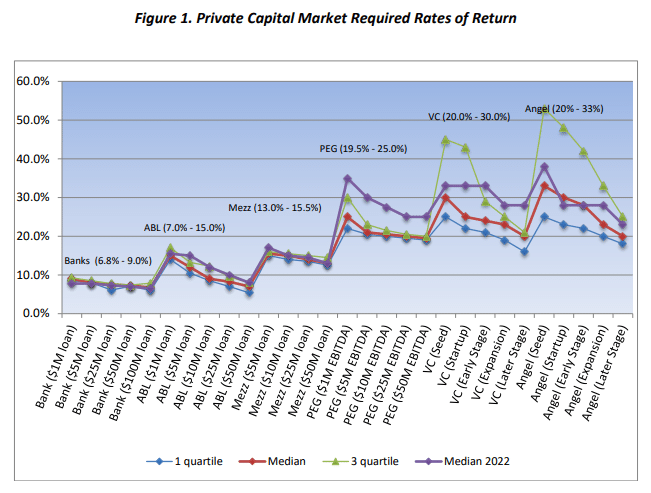

Pepperdine University publishes an annual report about funding sources for startup companies. In their latest report, they show that angel investors require median rates of return nearly 40% for seed rounds, and venture capital requires median rates of return between 30-35%.

As an entrepreneur, the sophisticated angel groups should be analyzing your business to see if you can produce returns in the 40%+ return on invested capital. That is an incredibly steep growth curve that you are required to meet. If you cannot show the classic hockey stick growth, angels will not likely invest.

Many angel groups will try to estimate whether that hockey stick growth rate is even possible in your situation, and – critically – whether you will need additional investment to get there. If you do require additional investment, a sophisticated angel will discount their return accordingly.

Angel/Venture Money is Much More Expensive Than the Rate of Return.

Angel and venture investors always have a different goal than an entrepreneur. The investor’s goal is to get a return, and their return comes only when the company is acquired or goes through an IPO. Until then, they want growth, growth, and more growth.

The angel/venture investors measure their effectiveness by internal rate of return (IRR) and by multiple of invested capital (MOIC). Funds that boast about their MOIC (“we returned 3x to investors”) often did so over a very long time, maybe a decade, and their IRR could have been 8% (which means investors would have been better off in a money market fund).

Funds that boast high IRR returns often have companies that are acquired quickly, and their MOIC will appear to be unspectacular.

IRR is the only meaningful comparison between investments other than angel/venture (such as commercial real estate, stock market, etc.) As such, the angel/venture investors will be pushing the company to be acquired or IPO from the first day.

The angel/venture incentive to acquisition or IPO is simple: that’s when they get their money back.

However, the entrepreneur is usually drawing a salary and enjoying growing the business. Especially when the business is going well and has so much potential, the entrepreneur typically wants to keep running the business while the angel/venture investor on the board of directors wants to sell. This highlights the conflicting interests of the investor and entrepreneur.

The Best Angel Groups are very Sophisticated.

The best angel groups are very sophisticated. They see innumerable opportunities, but they also have a track record of successes and failures to help guide them. In almost all angel groups, the failures are the investments that leave the longest impression.

The failed investments represent lessons learned from sometimes hundreds of investments. Since often 5% of the investments are “successful,” they have far more scars than successes. And those scars hurt much more than the joy of the “successful” investment.

The best angel groups have the most scars, and they also have the most comprehensive screening, evaluation, and diligence operations. Any entrepreneur pitching for investment will need to survive the gauntlet. But how can you prepare for this process?

Riding the Bus in the Minor Leagues.

Any entrepreneur who pitches to angel groups will get overwhelmed by the questions they will be asked. The more sophisticated angel groups will have the capacity to make big investments, but they will also ask the hardest questions and can knock you off your feet.

Because I am on a screening committee for one of the more sophisticated angel groups, I have an “in” where I can recommend entrepreneurs to jump the line and pitch to the group. In the past, I made the mistake of sending relatively “fresh meat” to the group, and they were shredded by the group (justifiably so).

I have started recommending that first-timers (or anyone wanting to get in shape) to pitch to our group “ride the bus” in the minor leagues.

A great resource is 1,000,000 cups. These groups meet every Wednesday at 9:00am across the country in 100+ locations. The purpose of the groups are to give entrepreneurs a forum to pitch their ideas and get feedback.

When I was starting out trying to refine my business model for IP-backed lending, I did the Million Cups ‘circuit’ in Colorado, which was Ft. Collins, Boulder, Denver, and Colorado Springs.

Some of the groups enforce “nice” feedback, which always left me confused without something to improve. But when I went to Colorado Springs, there was a former venture guy in the back of the room that found every weakness in my pitch, poked holes in all my arguments, and shredded my presentation. It was brutal, but the most loving thing someone could do for my business.

My two-hour ride home from the Springs was a long time for reflection, that interaction improved my ability to explain what I was doing, improve my value proposition, understand the issues from outside my organization, and overall made me a much, much better entrepreneur.

There are many smaller angel groups who welcome anyone to pitch. While these groups may not have lots of investors and may not be able to invest lots of money, the opportunity to pitch in front of a live audience, handle questions on the spot, and get feedback is invaluable.

The Angel Capital Association has a list of angel groups across the nation. My suggestion for anyone wanting to pitch at the larger angel groups is to get in a car, drive to Omaha, Des Moines, Tulsa, Boise, or wherever, and get some experience.

Always do the pitches in person and never by video. The magic happens when the video is shut off and members meet in the bar after the meeting. The magic happens beforehand, when a host from the angel group spends some time with the entrepreneurs showing them around their city. The magic happens the next day, when an investor asks to meet for breakfast before you get on the road. The magic is the personal, face to face interactions.

You Never Get “Good,” You Get Better.

Even the most experienced entrepreneur who has raised money from countless angel and venture firms can improve their pitch.

I encourage anyone trying to raise money to get as much “stick time” as possible. Pitch at as many different groups as humanly possible and constantly refine and improve your understanding of your product, customers, and value proposition.

Remember that raising money is just a different form of selling. The product is the business, and the customer is the investor. The investor wants to know what’s in it for them, and they want to get excited about this opportunity. The more you practice, the better you will be.